The best loan affiliate programs in 2026 give high payouts, verified lenders, and fast approval funnels. These programs use credit scoring systems, lender-matching engines, and secure tracking IDs. They support keywords such as loan affiliate programs, best loan affiliate programs for beginners in 2026, high-paying loan affiliate programs in 2026, and commercial loan broker affiliate programs. Entities like LendingTree, SoFi, Upgrade, Avant, Lendio, and Fundera operate trusted loan networks with transparent rate disclosures and regulated underwriting models.

Loan affiliate programs in 2026 cover personal loans, business loans, mortgage loans, and student loans. These programs use semantic terms such as lending CPA networks, loan referral commissions, and financial product partnerships. They maintain stable EPC, structured commission tiers, and optimized borrower funnels. This creates a strong environment for affiliates using blogs, comparison sites, and PPC traffic to promote the top loan affiliate programs in 2026.

What is a Loan Affiliate Program?

Loan affiliate marketing is a way for marketers, bloggers, and finance websites to earn commissions by promoting business loan affiliate programs, mortgage loan affiliate programs, personal loan referral payouts, payday loan affiliate programs, and student loan affiliate programs with high payouts. By partnering with lending affiliate networks, commercial loan broker affiliate programs, top fintech loan affiliate programs, and CPA loan offers, affiliates can drive high-intent traffic from users actively searching for loans. This market is highly profitable because it offers high-ticket loan affiliate programs with recurring commissions, instant approval loan affiliate programs, and credit loan affiliate offers for finance bloggers, allowing marketers to generate passive income while helping borrowers find the best financial solutions.

How to Make most money from Loan Affiliate Programs

Think finding a successful affiliate program is like searching for a unicorn? Not anymore. Loan affiliate programs, including business loan affiliate programs, mortgage loan affiliate programs, payday loan affiliate programs, and student loan affiliate programs with high payouts, can be a highly profitable opportunity if promoted strategically. By partnering with lending affiliate networks, commercial loan broker affiliate programs, and top fintech loan affiliate programs in 2026, you can earn high commissions, referral payouts, and recurring revenue while helping borrowers find the right financial solutions.

Benefits and Secrets of Loan Affiliate Programs

To earn maximum revenue, it’s crucial to choose the right programs and promote them effectively. Commission rates and EPC (earnings per click) vary widely. Some programs pay modestly, while high-ticket loan affiliate programs with recurring commissions can offer 50% or more per lead. Specializing in niches like instant approval loan affiliate programs, payday loans, and credit loan affiliate offers for finance bloggers can boost conversions and increase income. With dedication, a strong online presence, and high-quality content, the loan affiliate market offers enormous potential for passive income.

How to Choose the Right Loan Affiliate Program

Choosing the right affiliate program requires balancing high conversion potential with a structure that supports your specific traffic and niche. The most effective approach is to prioritize products that solve your audience’s problems, ensuring that your recommendations feel like helpful solutions rather than a forced sales pitch.

- Analyze Commission and Payout Structure: Look for programs that offer a fair balance between commission rates (percentage vs. flat fee) and the “earnings per click” (EPC) to ensure the effort is profitable.

- Evaluate Cookie Duration: Prioritize programs with longer cookie lives (e.g., 30 to 90 days) so you still receive credit even if a customer takes several weeks to make a final purchase decision.

- Verify Product Quality and Brand Reputation: Only partner with reputable companies that provide high-quality products, as promoting a poor service will damage your audience’s trust and your long-term credibility.

- Check Payment Reliability and Thresholds: Ensure the program has a reasonable minimum payout limit and supports payment methods that are easily accessible in your region to avoid “locked” earnings.

- Assess Marketing Support and Resources: Choose programs that provide ready-to-use banners, deep-linking tools, and a responsive affiliate manager to help you optimize your content and troubleshoot issues.

Best Loan Affiliate Programs In 2026:

Here is the list of the top 10 best Loan Affiliate Programs in 2026:

- LendingTree

- Bankrate

- Credible

- SoFi

- Avant

- Upgrade

- RefiJet

- LendKey

- MoneyMutual

- Credibly

1. LendingTree

LendingTree is one of the most recognized names in finance and provides affiliates access to business loan affiliate programs, mortgage loan affiliate programs, personal loan referral payouts, and payday loan affiliate programs. With LendingTree, affiliates can promote multiple financial products, including credit loans, commercial loans, and mortgage refinancing. This platform is highly suitable for finance bloggers, fintech websites, and loan comparison affiliates who want to monetize high-intent traffic and convert visitors into qualified leads.

LendingTree is one of the most recognized names in finance and provides affiliates access to business loan affiliate programs, mortgage loan affiliate programs, personal loan referral payouts, and payday loan affiliate programs. With LendingTree, affiliates can promote multiple financial products, including credit loans, commercial loans, and mortgage refinancing. This platform is highly suitable for finance bloggers, fintech websites, and loan comparison affiliates who want to monetize high-intent traffic and convert visitors into qualified leads.

The program is designed to support both beginners and experienced marketers with high-ticket loan affiliate programs with recurring commissions. Affiliates benefit from a wide variety of loan types, instant approval options, and opportunities to promote student loan affiliate programs with high payouts. LendingTree’s trusted brand and robust affiliate dashboard make tracking performance and optimizing campaigns straightforward, allowing marketers to scale their loan affiliate business effectively.

Pros:

- Offers high EPC for personal, mortgage, and business loans, making it easier for affiliates to earn significant commissions per qualified lead.

- Provides a wide variety of loan products, including personal loans, business loans, and mortgage options, giving affiliates multiple avenues to monetize their content.

- Recurring commissions are available for certain loan types, allowing affiliates to earn passive income over time.

- LendingTree is a trusted and established brand, which increases the likelihood of conversions due to high user trust.

- The affiliate approval and onboarding process is fast, enabling marketers to start promoting offers quickly without lengthy delays.

Cons:

- Operates in a competitive niche, requiring affiliates to produce quality content to stand out and attract high-intent traffic.

- Some loan offers have regional restrictions, limiting opportunities for affiliates targeting international audiences.

- Lower commissions are offered for certain loan types, meaning affiliates need to carefully choose high-performing products.

- To achieve consistent earnings, affiliates must actively promote loan products through websites, blogs, or social media channels.

- Beginners without established traffic may find it challenging to generate significant revenue initially.

Payment / Affiliate Details:

- Commission Type: CPA-based

- Payout Range: $25–$100 per qualified lead

- Payment Frequency: Monthly

- Tracking: Affiliate dashboard with real-time tracking

- Program Highlights: Supports loan referral commissions, lending CPA networks, and finance affiliate marketing

2. Bankrate

Bankrate is a leading platform for top personal loan affiliate networks, commercial loan broker affiliate programs, and mortgage loan affiliate programs. Affiliates can promote a wide variety of financial products, from payday loans and credit loans to mortgage refinancing and student loans. Bankrate’s program is ideal for bloggers and websites in the finance niche who want to leverage high-intent keywords, lending affiliate networks, and commercial lending partnerships to maximize revenue.

Bankrate is a leading platform for top personal loan affiliate networks, commercial loan broker affiliate programs, and mortgage loan affiliate programs. Affiliates can promote a wide variety of financial products, from payday loans and credit loans to mortgage refinancing and student loans. Bankrate’s program is ideal for bloggers and websites in the finance niche who want to leverage high-intent keywords, lending affiliate networks, and commercial lending partnerships to maximize revenue.

Affiliates also benefit from detailed reporting, a strong brand presence, and access to multiple CPA loan offers. With a focus on loan comparison affiliates and financial product partnerships, Bankrate helps affiliates generate passive income by connecting borrowers to trusted lenders. This program is perfect for content creators targeting both beginners and experienced borrowers seeking instant approval loan affiliate programs.

Pros:

- Bankrate is a trusted finance brand that helps affiliates build credibility and increase user confidence when clicking on promoted loan offers.

- High commission rates are available for qualified leads, especially for personal and mortgage loans, which can significantly boost affiliate income.

- Provides access to a wide variety of financial products, allowing marketers to promote multiple loan types and increase conversion potential.

- Easy integration with websites and blogs makes it simple for affiliates to embed banners, links, and content for effective promotion.

- Detailed reporting and analytics help affiliates monitor performance, optimize campaigns, and make data-driven decisions to maximize earnings.

Cons:

- The approval process for affiliates can be strict, requiring proper documentation and adherence to program guidelines.

- Limited international offers restrict affiliates targeting audiences outside the US, reducing global reach.

- Conversions are dependent on the type of loan being promoted, meaning some products may require more effort to generate leads.

- The affiliate market is competitive, so content quality and marketing strategy play a crucial role in success.

- Affiliates need to maintain high-quality, consistent content to ensure ongoing engagement and conversion from visitors.

Payment / Affiliate Details:

- Commission Type: CPA-based

- Payout Range: $30–$75 per qualified lead

- Payment Frequency: Monthly

- Tracking: Affiliate dashboard with detailed analytics

- Program Highlights: Supports loan partner programs, high-commission loan deals, and mortgage lead generation

3. Credible

Credible is a top choice for affiliates interested in student loan affiliate programs, personal loans, and mortgage loan affiliate programs. Affiliates can promote multiple lenders through loan partner programs, lending CPA networks, and high-commission loan deals, helping borrowers find the best financing options. With high-intent keywords, EPC, and referral payouts, Credible allows marketers to monetize finance blogs, fintech websites, and loan comparison affiliates effectively.

Credible is a top choice for affiliates interested in student loan affiliate programs, personal loans, and mortgage loan affiliate programs. Affiliates can promote multiple lenders through loan partner programs, lending CPA networks, and high-commission loan deals, helping borrowers find the best financing options. With high-intent keywords, EPC, and referral payouts, Credible allows marketers to monetize finance blogs, fintech websites, and loan comparison affiliates effectively.

The program is beginner-friendly and also suitable for experienced marketers who want to tap into high-ticket loan affiliate programs with recurring commissions and instant approval loan affiliate programs. Affiliates can benefit from strong brand recognition, diverse loan products, and a user-friendly dashboard that tracks clicks, leads, and conversions in real-time, making scaling their loan affiliate business easier.

Pros:

- Offers high commission rates on student and personal loans, allowing affiliates to earn significant revenue from qualified leads.

- Provides recurring commission opportunities for specific loan types, creating a steady income stream over time.

- Strong brand recognition builds trust with borrowers, which increases the likelihood of lead conversion.

- Wide range of lenders and loan products enables affiliates to promote multiple financing solutions to different audiences.

- User-friendly affiliate dashboard allows easy tracking of clicks, leads, and commissions, helping affiliates optimize their campaigns effectively.

Cons:

- Some loans have strict eligibility criteria, which may limit the pool of potential leads for affiliates.

- Niche-specific products can have lower conversion rates if not promoted to the right audience.

- Program is limited to the US, restricting affiliates who want to target international markets.

- The competitive affiliate market requires high-quality content to stand out and attract high-intent traffic.

- Affiliates need consistent effort in content creation and promotion to maintain steady earnings.

Payment / Affiliate Details:

- Commission Type: CPA-based

- Payout Range: $50–$100 per qualified lead

- Payment Frequency: Monthly

- Tracking: Real-time dashboard

- Program Highlights: Supports finance affiliate marketing, high-intent keywords, and loan referral commissions

4. SoFi

SoFi offers affiliates access to high-ticket loan affiliate programs, including personal loans, student loan refinancing, and mortgages. This platform is ideal for finance bloggers and loan comparison affiliates who want to earn through CPA loan offers, lending affiliate networks, and commercial lending partnerships. The program focuses on high-intent borrowers, ensuring affiliates get quality leads that are more likely to convert.

SoFi offers affiliates access to high-ticket loan affiliate programs, including personal loans, student loan refinancing, and mortgages. This platform is ideal for finance bloggers and loan comparison affiliates who want to earn through CPA loan offers, lending affiliate networks, and commercial lending partnerships. The program focuses on high-intent borrowers, ensuring affiliates get quality leads that are more likely to convert.

Affiliates can promote a wide range of instant approval loan affiliate programs, business loan affiliate programs, and payday loan affiliate programs with high conversion rates. With recurring commission structures and strong brand credibility, SoFi allows marketers to generate passive income while helping borrowers find tailored loan solutions across multiple loan categories.

Pros:

- Provides high payout per qualified lead, particularly for personal loans and student loan refinancing, boosting affiliate earnings.

- Supports multiple loan types, including mortgages, personal loans, and student loans, allowing affiliates to diversify promotions.

- Trusted fintech brand increases user confidence, resulting in higher conversion rates for promoted offers.

- Recurring commission opportunities allow affiliates to earn ongoing revenue from returning customers.

- Excellent affiliate support and resources help marketers understand the program and optimize their campaigns efficiently.

Cons:

- Limited to US-based affiliates, which restricts global promotional opportunities.

- Strict compliance rules require affiliates to follow precise marketing guidelines.

- Competitive affiliate market demands unique and high-quality content for success.

- High-quality content creation is necessary to convert high-intent traffic effectively.

- Certain loan offers are seasonal, requiring affiliates to adjust campaigns based on market trends.

Payment / Affiliate Details:

- Commission Type: CPA-based

- Payout Range: $100 per approved lead

- Payment Frequency: Monthly

- Tracking: Real-time affiliate dashboard

- Program Highlights: Supports student loan affiliate programs with high payouts, mortgage lead generation, and high-commission loan deals

5. Avant

Avant provides affiliates with access to commercial loan affiliate programs for small businesses, personal loans, and credit loan affiliate offers. Affiliates can monetize finance websites, fintech blogs, and lending CPA networks by promoting high-quality loan products to borrowers actively seeking financing solutions. Avant emphasizes trust and reliability, which helps affiliates increase conversions and EPC.

Avant provides affiliates with access to commercial loan affiliate programs for small businesses, personal loans, and credit loan affiliate offers. Affiliates can monetize finance websites, fintech blogs, and lending CPA networks by promoting high-quality loan products to borrowers actively seeking financing solutions. Avant emphasizes trust and reliability, which helps affiliates increase conversions and EPC.

The platform offers opportunities for instant approval loan affiliate programs, high-ticket loan affiliate programs with recurring commissions, and business financing partners. Avant’s affiliate dashboard is simple to use, with detailed analytics for tracking clicks, conversions, and commission payouts, making it suitable for both beginners and experienced marketers.

Pros:

- High commission rates for personal, business, and credit loan affiliate offers make it a lucrative program for affiliates.

- Fast affiliate approval allows marketers to start promoting loan products quickly without long waiting periods.

- Offers multiple loan categories, including commercial and personal loans, providing flexibility for content promotion.

- User-friendly affiliate dashboard with analytics helps affiliates track leads, conversions, and optimize campaigns.

- Trusted fintech brand enhances credibility and encourages borrowers to engage with promoted offers.

Cons:

- Geographic restrictions on some loan products limit global affiliate marketing opportunities.

- Affiliates need to actively promote offers to achieve consistent conversions and revenue.

- A competitive market requires strong marketing strategies and quality content for success.

- Certain loan types do not offer recurring payouts, reducing long-term passive income potential.

- Beginners may face a learning curve in understanding loan product promotion and campaign optimization.

Payment / Affiliate Details:

- Commission Type: CPA-based

- Payout Range: $50–$75 per qualified lead

- Payment Frequency: Monthly

- Tracking: Affiliate dashboard with analytics

- Program Highlights: Supports commercial lending partnerships, loan referral commissions, and high-commission loan deals

6. Upgrade

Upgrade offers affiliates access to instant approval loan affiliate programs, payday loan affiliate programs, and personal loan referral payouts. Marketers can leverage CPA loan offers, lending CPA networks, and finance affiliate marketing to earn high commissions while helping borrowers find flexible loan solutions. Upgrade is suitable for finance blogs, personal finance websites, and fintech platforms.

Upgrade offers affiliates access to instant approval loan affiliate programs, payday loan affiliate programs, and personal loan referral payouts. Marketers can leverage CPA loan offers, lending CPA networks, and finance affiliate marketing to earn high commissions while helping borrowers find flexible loan solutions. Upgrade is suitable for finance blogs, personal finance websites, and fintech platforms.

Affiliates can earn from high-ticket loan affiliate programs with recurring commissions, student loan affiliate programs with high payouts, and commercial loan affiliate programs for small businesses. With strong analytics, real-time tracking, and a user-friendly dashboard, Upgrade makes it simple for affiliates to monitor performance and optimize their campaigns.

Pros:

- Quick affiliate approval allows marketers to start promoting loan offers immediately, minimizing waiting time.

- Multiple loan types, including personal, payday, and student loans, offer flexibility for affiliate promotion.

- High conversion potential due to targeted high-intent traffic and instant approval loan affiliate programs.

- Recurring revenue opportunities allow affiliates to generate passive income over time.

- Excellent affiliate support and resources help affiliates optimize campaigns for maximum results.

Cons:

- The program is limited to US-based affiliates, restricting global outreach.

- Niche-specific competition requires high-quality content and marketing strategies to succeed.

- Some loan types may have lower EPC, impacting revenue per lead.

- Consistent effort in content creation and promotion is required for sustained conversions.

- Seasonal variation in loan demand may affect overall affiliate earnings.

Payment / Affiliate Details:

- Commission Type: CPA-based

- Payout Range: $50–$80 per qualified lead

- Payment Frequency: Monthly

- Tracking: Affiliate dashboard with real-time analytics

- Program Highlights: Supports loan referral commissions, lending CPA networks, and high-commission loan deals

7. RefiJet

RefiJet specializes in mortgage loan affiliate programs and loan comparison affiliates, helping borrowers refinance their mortgages efficiently. Affiliates can earn by promoting loan partner programs, mortgage lead generation, and commercial loan broker affiliate programs. This program targets high-intent users, ensuring quality leads and higher conversion rates.

RefiJet specializes in mortgage loan affiliate programs and loan comparison affiliates, helping borrowers refinance their mortgages efficiently. Affiliates can earn by promoting loan partner programs, mortgage lead generation, and commercial loan broker affiliate programs. This program targets high-intent users, ensuring quality leads and higher conversion rates.

RefiJet is ideal for finance bloggers, mortgage websites, and personal finance content creators who want to focus on instant approval loan affiliate programs and high-ticket loan affiliate programs with recurring commissions. The platform provides a detailed dashboard for tracking clicks, conversions, and earnings.

Pros:

- High EPC on mortgage leads ensures affiliates earn substantial revenue from qualified conversions.

- A focused niche on mortgage refinancing allows affiliates to target high-intent borrowers effectively.

- Recurring commissions provide ongoing income opportunities for affiliates promoting refinance offers.

- Trusted mortgage brand builds credibility and increases user confidence in promoted products.

- User-friendly affiliate portal simplifies tracking of clicks, leads, and earnings, making optimization straightforward.

Cons:

- The program is US-focused, limiting international affiliate marketing opportunities.

- A narrow niche focus reduces the variety of products affiliates can promote.

- Competitive market for mortgage leads requires strong content and marketing skills.

- Consistent promotion is necessary to maintain steady lead generation and revenue.

- Limited cross-promotion opportunities with other loan types can restrict earning potential.

Payment / Affiliate Details:

- Commission Type: CPA-based

- Payout Range: $75–$150 per lead

- Payment Frequency: Monthly

- Tracking: Real-time affiliate dashboard

- Program Highlights: Supports loan comparison affiliates, finance affiliate marketing, and high-intent keywords

8. LendKey

LendKey provides access to student loans, personal loans, and credit loan affiliate offers. Affiliates can leverage lending CPA networks, high-commission loan deals, and loan referral commissions to monetize websites and blogs effectively. LendKey is suitable for finance bloggers, educational platforms, and fintech websites.

LendKey provides access to student loans, personal loans, and credit loan affiliate offers. Affiliates can leverage lending CPA networks, high-commission loan deals, and loan referral commissions to monetize websites and blogs effectively. LendKey is suitable for finance bloggers, educational platforms, and fintech websites.

Affiliates benefit from instant approval loan affiliate programs, high-ticket loan affiliate programs with recurring commissions, and business financing partners. The dashboard offers detailed analytics for tracking conversions, clicks, and earnings, making campaign optimization straightforward.

Pros:

- High commission rates for student and personal loans allow affiliates to generate significant earnings per lead.

- Trusted brand enhances credibility and improves lead conversion rates.

- Recurring payouts for qualifying loans provide affiliates with passive income opportunities.

- Multiple loan types for promotion, including personal, student, and credit loans, offer flexibility for content creators.

- User-friendly affiliate dashboard makes it simple to monitor conversions, clicks, and overall performance.

Cons:

- The program is limited to US affiliates, restricting global promotional opportunities.

- Seasonal fluctuations in loan applications may impact earnings consistency.

- High-quality content creation is necessary to maximize conversions and commissions.

- Some loans have strict eligibility criteria, limiting the number of qualified leads.

- A competitive affiliate niche requires affiliates to differentiate themselves with strong marketing strategies.

Payment / Affiliate Details:

- Commission Type: CPA-based

- Payout Range: $50–$100 per lead

- Payment Frequency: Monthly

- Tracking: Affiliate dashboard for conversion analytics

- Program Highlights: Supports finance affiliate marketing, high-intent keywords, and loan referral commissions

9. MoneyMutual

MoneyMutual focuses on payday loan affiliate programs with high conversion rates. Affiliates can earn through loan referral commissions, high-ticket loan affiliate programs, and lending CPA networks by connecting borrowers with payday loan solutions. This program is highly suitable for finance websites and personal finance blogs targeting high-intent traffic.

MoneyMutual offers instant approval loan affiliate programs, personal loan referral payouts, and student loan affiliate programs with high payouts. The platform is beginner-friendly, with real-time tracking and analytics to optimize campaigns and increase EPC.

Pros:

- High conversion rates for payday loan affiliate programs make it easy for affiliates to earn commissions quickly.

- Quick payouts ensure affiliates receive earnings promptly, improving cash flow.

- Easy integration with websites and blogs allows for seamless promotion of loan offers.

- A large target audience for payday loans increases the likelihood of lead generation.

- Strong affiliate support and resources help marketers optimize campaigns for better performance.

Cons:

- The program is limited to the US and Canada, restricting affiliates from targeting other regions.

- Only payday loans are offered, limiting diversification of promoted products.

- A competitive affiliate market requires high-quality content and effective marketing strategies.

- Some leads may not convert, impacting overall revenue.

- Consistent marketing effort is necessary to maintain steady affiliate income.

Payment / Affiliate Details:

- Commission Type: CPA-based

- Payout Range: $30–$70 per lead

- Payment Frequency: Weekly

- Tracking: Real-time affiliate dashboard

- Program Highlights: Supports loan referral commissions, payday loan affiliate programs, and high-intent keywords

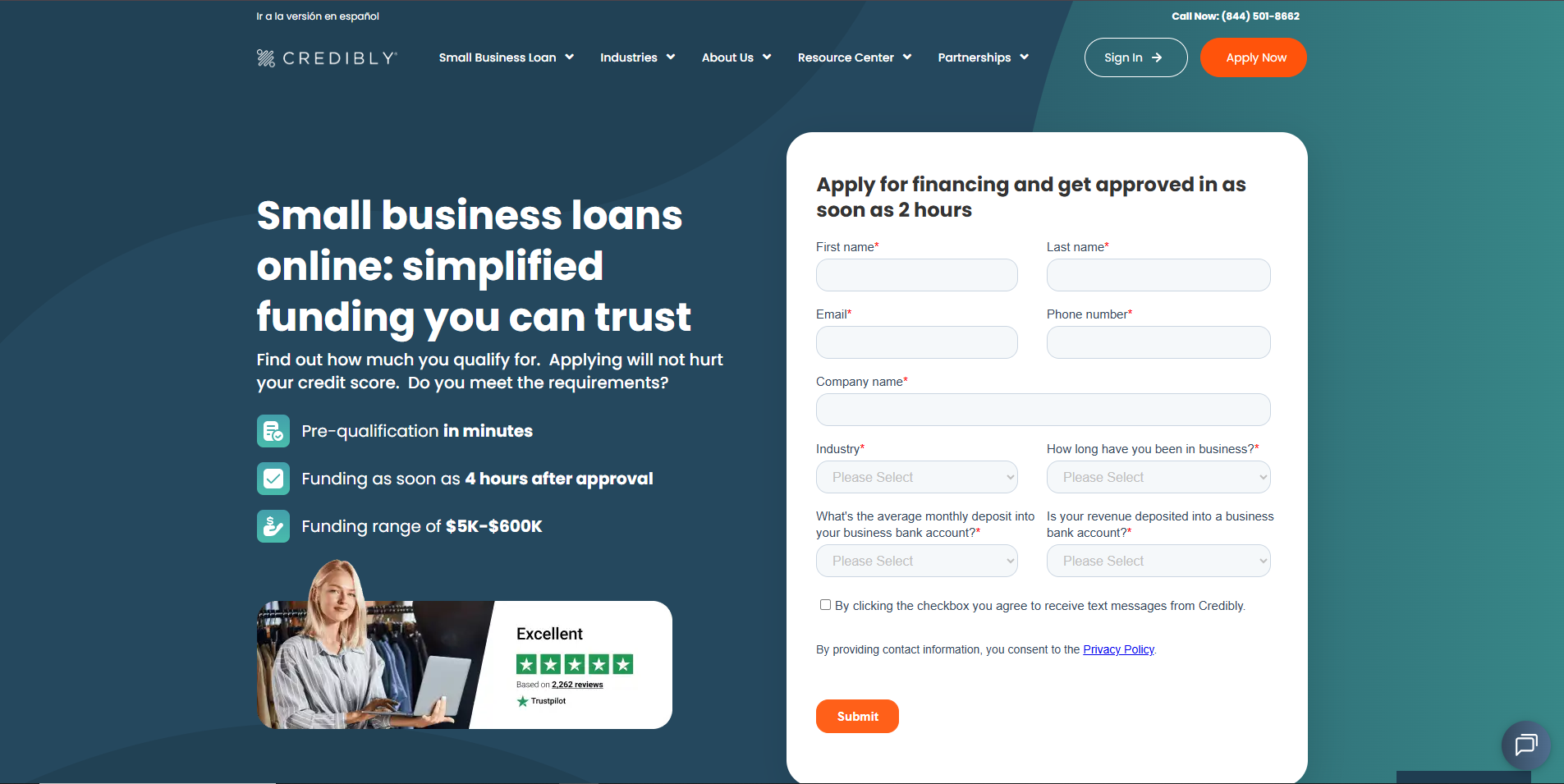

10. Credibly

Credibly provides access to commercial loan affiliate programs for small businesses, business financing partners, and lending CPA networks. Affiliates can earn by connecting small business owners to suitable loan solutions, including business loan affiliate programs, instant approval loan affiliate programs, and high-ticket loan affiliate programs with recurring commissions.

Credibly provides access to commercial loan affiliate programs for small businesses, business financing partners, and lending CPA networks. Affiliates can earn by connecting small business owners to suitable loan solutions, including business loan affiliate programs, instant approval loan affiliate programs, and high-ticket loan affiliate programs with recurring commissions.

The program is ideal for finance bloggers, fintech websites, and commercial lending affiliates. Credibly offers a user-friendly affiliate dashboard, detailed analytics, and real-time tracking to help marketers optimize campaigns and increase conversions for loan partner programs and commercial lending partnerships.

Pros:

- High EPC and commission rates for business loans allow affiliates to earn substantial revenue from qualified leads.

- Multiple business loan products provide flexibility in promotion and content creation.

- Recurring revenue opportunities for specific loan types create long-term passive income streams.

- Quick affiliate approval allows marketers to start promoting products without delay.

- User-friendly affiliate dashboard provides detailed analytics to optimize campaigns and track performance effectively.

Cons:

- The program is US-focused, limiting international promotion options.

- High-quality content creation is required to generate consistent conversions.

- Competitive affiliate niche necessitates strong marketing strategies and unique content.

- Not ideal for beginners without an established audience or traffic.

- Limited availability of non-business loans reduces the scope of diversification for affiliates.

Payment / Affiliate Details:

- Commission Type: CPA-based

- Payout Range: $50–$120 per qualified lead

- Payment Frequency: Monthly

- Tracking: Real-time affiliate dashboard

- Program Highlights: Supports commercial lending partnerships, loan referral commissions, and high-commission loan deals

Conclusion:

Loan affiliate marketing offers a lucrative way to earn commissions by promoting personal, business, mortgage, and payday loans. By joining trusted programs like LendingTree, Bankrate, and SoFi, affiliates can leverage high-intent traffic, loan referral commissions, and high-commission loan deals to generate passive income. Success comes from choosing the right loan products, providing helpful content, and consistently connecting with your audience.

Even beginners can benefit from the best loan affiliate programs for beginners in 2026 by focusing on quality promotion and targeting the right audience. With the right strategy, loan affiliate marketing can become a sustainable source of revenue while helping borrowers find the financial solutions they need.

Read more

10 Best Email Marketing Affiliate Programs In 2026

10 Best Fitness Bloggers Affiliate Programs in 2026

Frequently Asked Questions (FAQS)

Is loan affiliate marketing really profitable, or is it just hype?

Yes, loan affiliate marketing can be highly profitable. Payouts range from $50 to $300+ per qualified lead, depending on the program. Programs with high-ticket loans, recurring commissions, and high-intent traffic offer affiliates the opportunity to earn substantial revenue.

What’s the easiest way to start as a newbie in loan affiliate marketing?

Begin by joining a reputable affiliate program that offers good payouts and reliable tracking. Build an online presence through a blog, niche website, or social media, and create helpful content targeting users searching for personal, business, or payday loans. Focus on quality promotion and track performance to optimize conversions.

Can Reddit or Quora help drive affiliate traffic for loan offers?

Yes, but direct affiliate links are often discouraged. It’s more effective to share helpful content and direct users to your website or landing page, where your affiliate links are placed. This builds trust and avoids spam issues.

What are the common mistakes beginners make in loan affiliate marketing?

Beginners often promote too many offers at once, drive low-quality traffic, ignore compliance and disclosure rules, or start without a clear content and marketing strategy. Consistency, honest advice, and targeted promotion are key to success.

Is loan affiliate marketing legal and ethical?

Yes, it’s legal if you follow affiliate program rules and local advertising laws. Ethically, you should disclose affiliate relationships, avoid misleading claims, and present both benefits and risks to maintain trust with your audience.

Which type of loan affiliate programs pay the highest commissions?

High-ticket loan affiliate programs, mortgage loan affiliates, and certain business loan or payday loan programs tend to pay the highest commissions. Programs offering recurring payouts for approved leads can also generate long-term passive income.

How can I improve conversion rates in loan affiliate marketing?

Focus on high-intent keywords, provide accurate and helpful content, choose trustworthy loan products, and engage with your audience. Optimizing landing pages, using email marketing, and targeting users actively searching for loans can also boost conversions.

Can beginners earn passive income from loan affiliate programs?

Yes, especially through programs with recurring commissions or high-ticket loans. By creating evergreen content such as blog posts, guides, or comparison articles, affiliates can generate ongoing income from qualified leads over time.

LendingTree is one of the most recognized names in finance and provides affiliates access to business loan affiliate programs, mortgage loan affiliate programs, personal loan referral payouts, and payday loan affiliate programs. With LendingTree, affiliates can promote multiple financial products, including credit loans, commercial loans, and mortgage refinancing. This platform is highly suitable for finance bloggers, fintech websites, and loan comparison affiliates who want to monetize high-intent traffic and convert visitors into qualified leads.

LendingTree is one of the most recognized names in finance and provides affiliates access to business loan affiliate programs, mortgage loan affiliate programs, personal loan referral payouts, and payday loan affiliate programs. With LendingTree, affiliates can promote multiple financial products, including credit loans, commercial loans, and mortgage refinancing. This platform is highly suitable for finance bloggers, fintech websites, and loan comparison affiliates who want to monetize high-intent traffic and convert visitors into qualified leads. Bankrate is a leading platform for top personal loan affiliate networks, commercial loan broker affiliate programs, and mortgage loan affiliate programs. Affiliates can promote a wide variety of financial products, from payday loans and credit loans to mortgage refinancing and student loans. Bankrate’s program is ideal for bloggers and websites in the finance niche who want to leverage high-intent keywords, lending affiliate networks, and commercial lending partnerships to maximize revenue.

Bankrate is a leading platform for top personal loan affiliate networks, commercial loan broker affiliate programs, and mortgage loan affiliate programs. Affiliates can promote a wide variety of financial products, from payday loans and credit loans to mortgage refinancing and student loans. Bankrate’s program is ideal for bloggers and websites in the finance niche who want to leverage high-intent keywords, lending affiliate networks, and commercial lending partnerships to maximize revenue. Credible is a top choice for affiliates interested in student loan affiliate programs, personal loans, and mortgage loan affiliate programs. Affiliates can promote multiple lenders through loan partner programs, lending CPA networks, and high-commission loan deals, helping borrowers find the best financing options. With high-intent keywords, EPC, and referral payouts, Credible allows marketers to monetize finance blogs, fintech websites, and loan comparison affiliates effectively.

Credible is a top choice for affiliates interested in student loan affiliate programs, personal loans, and mortgage loan affiliate programs. Affiliates can promote multiple lenders through loan partner programs, lending CPA networks, and high-commission loan deals, helping borrowers find the best financing options. With high-intent keywords, EPC, and referral payouts, Credible allows marketers to monetize finance blogs, fintech websites, and loan comparison affiliates effectively. SoFi offers affiliates access to high-ticket loan affiliate programs, including personal loans, student loan refinancing, and mortgages. This platform is ideal for finance bloggers and loan comparison affiliates who want to earn through CPA loan offers, lending affiliate networks, and commercial lending partnerships. The program focuses on high-intent borrowers, ensuring affiliates get quality leads that are more likely to convert.

SoFi offers affiliates access to high-ticket loan affiliate programs, including personal loans, student loan refinancing, and mortgages. This platform is ideal for finance bloggers and loan comparison affiliates who want to earn through CPA loan offers, lending affiliate networks, and commercial lending partnerships. The program focuses on high-intent borrowers, ensuring affiliates get quality leads that are more likely to convert. Avant provides affiliates with access to commercial loan affiliate programs for small businesses, personal loans, and credit loan affiliate offers. Affiliates can monetize finance websites, fintech blogs, and lending CPA networks by promoting high-quality loan products to borrowers actively seeking financing solutions. Avant emphasizes trust and reliability, which helps affiliates increase conversions and EPC.

Avant provides affiliates with access to commercial loan affiliate programs for small businesses, personal loans, and credit loan affiliate offers. Affiliates can monetize finance websites, fintech blogs, and lending CPA networks by promoting high-quality loan products to borrowers actively seeking financing solutions. Avant emphasizes trust and reliability, which helps affiliates increase conversions and EPC. Upgrade offers affiliates access to instant approval loan affiliate programs, payday loan affiliate programs, and personal loan referral payouts. Marketers can leverage CPA loan offers, lending CPA networks, and finance affiliate marketing to earn high commissions while helping borrowers find flexible loan solutions. Upgrade is suitable for finance blogs, personal finance websites, and fintech platforms.

Upgrade offers affiliates access to instant approval loan affiliate programs, payday loan affiliate programs, and personal loan referral payouts. Marketers can leverage CPA loan offers, lending CPA networks, and finance affiliate marketing to earn high commissions while helping borrowers find flexible loan solutions. Upgrade is suitable for finance blogs, personal finance websites, and fintech platforms. RefiJet specializes in mortgage loan affiliate programs and loan comparison affiliates, helping borrowers refinance their mortgages efficiently. Affiliates can earn by promoting loan partner programs, mortgage lead generation, and commercial loan broker affiliate programs. This program targets high-intent users, ensuring quality leads and higher conversion rates.

RefiJet specializes in mortgage loan affiliate programs and loan comparison affiliates, helping borrowers refinance their mortgages efficiently. Affiliates can earn by promoting loan partner programs, mortgage lead generation, and commercial loan broker affiliate programs. This program targets high-intent users, ensuring quality leads and higher conversion rates. LendKey provides access to student loans, personal loans, and credit loan affiliate offers. Affiliates can leverage lending CPA networks, high-commission loan deals, and loan referral commissions to monetize websites and blogs effectively. LendKey is suitable for finance bloggers, educational platforms, and fintech websites.

LendKey provides access to student loans, personal loans, and credit loan affiliate offers. Affiliates can leverage lending CPA networks, high-commission loan deals, and loan referral commissions to monetize websites and blogs effectively. LendKey is suitable for finance bloggers, educational platforms, and fintech websites.

Credibly provides access to commercial loan affiliate programs for small businesses, business financing partners, and lending CPA networks. Affiliates can earn by connecting small business owners to suitable loan solutions, including business loan affiliate programs, instant approval loan affiliate programs, and high-ticket loan affiliate programs with recurring commissions.

Credibly provides access to commercial loan affiliate programs for small businesses, business financing partners, and lending CPA networks. Affiliates can earn by connecting small business owners to suitable loan solutions, including business loan affiliate programs, instant approval loan affiliate programs, and high-ticket loan affiliate programs with recurring commissions.

No Comments

I believe other website owners should take this web site as an model, very clean and superb user pleasant pattern.

Your comment is awaiting moderation.